Unemployment Rates Surge Amid Economic Uncertainty

Unemployment Rates Surge Amid Economic Uncertainty

The Current State of Unemployment

In the wake of the ongoing economic uncertainty, one of the most glaring issues facing the United States is the surge in unemployment rates. Despite initial signs of recovery, many individuals continue to struggle to find stable employment opportunities. This phenomenon has been exacerbated by various factors, including the lingering effects of the COVID-19 pandemic, shifts in consumer behavior, and disruptions in traditional industries.

Factors Contributing to Unemployment

Several factors have contributed to the persistent rise in unemployment rates. First and foremost is the impact of the COVID-19 pandemic, which prompted widespread layoffs and forced many businesses to close their doors permanently. While some sectors have experienced a rebound, others continue to face significant challenges, particularly those reliant on in-person interactions or heavily affected by supply chain disruptions.

Challenges in Reentering the Workforce

For many individuals, reentering the workforce has proven to be a daunting task. Long periods of unemployment can erode skills and confidence, making it difficult to compete in a rapidly evolving job market. Furthermore, certain demographic groups, such as minorities and individuals with lower levels of education, have been disproportionately affected by job losses, widening existing disparities in employment opportunities.

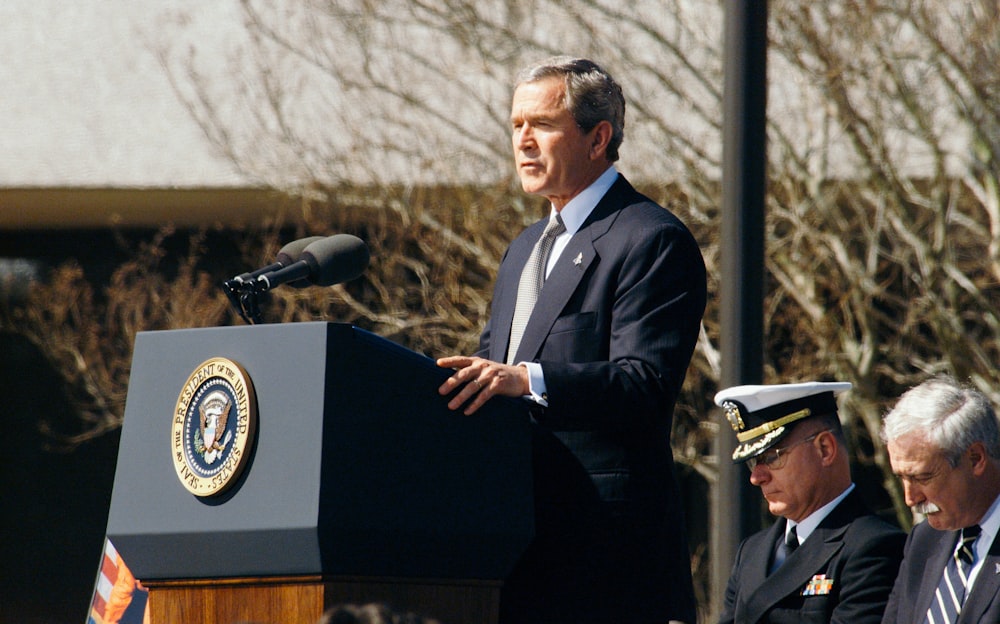

Government Response and Stimulus Measures

In response to the economic downturn, the government has implemented various stimulus measures aimed at mitigating the impact of unemployment. These measures have included direct payments to individuals, expanded unemployment benefits, and assistance programs for struggling businesses. While these initiatives have provided temporary relief for many, questions remain about their long-term effectiveness and sustainability.

The Role of Education and Training

Addressing the challenges of unemployment requires a multifaceted approach that includes investments in education and workforce training. Equipping individuals with the skills needed to succeed in emerging industries is essential for fostering long-term economic resilience. Additionally, initiatives aimed at promoting entrepreneurship and small business development can create new opportunities for job seekers and spur economic growth.

Navigating the Gig Economy

The rise of the gig economy has presented both opportunities and challenges for workers seeking alternative sources of income. While platforms such as Uber, Lyft, and TaskRabbit offer flexibility and autonomy, they also lack the stability and benefits associated with traditional employment. As more individuals turn to gig work to make ends meet, policymakers must address issues related to worker rights, labor protections, and social safety nets.

Investing in Infrastructure and Innovation

Investments in infrastructure and innovation are critical for driving economic growth and creating new employment opportunities. Modernizing aging infrastructure, such as roads, bridges, and public transportation systems, not only creates jobs in the short term but also lays the foundation for future prosperity. Similarly, supporting research and development in emerging technologies can spur innovation and entrepreneurship, leading to the creation of high-paying jobs in cutting-edge industries.

Conclusion

The surge in unemployment rates amid economic uncertainty underscores the need for proactive measures to support job creation, workforce development, and economic resilience. By addressing the root causes of unemployment and investing